Every month, about twenty people from Calgary gather, just as they have been doing for twenty years.

The group skews older, but includes people in their 30s, too. Starting at seven o’clock in the evening, they deal with about twelve issues before stopping at nine o’clock.

Tonight’s topic: money.

The topic is always money at Calgary ShareClub.

Where people go to talk about money

Personal finance is important to millions of Canadians. Almost two in five Canadians (41%) say they have sought financial advice in the past year, according to the latest Canadian Financial Capability Survey, conducted by Financial Consumer Agency of Canada in 2019.

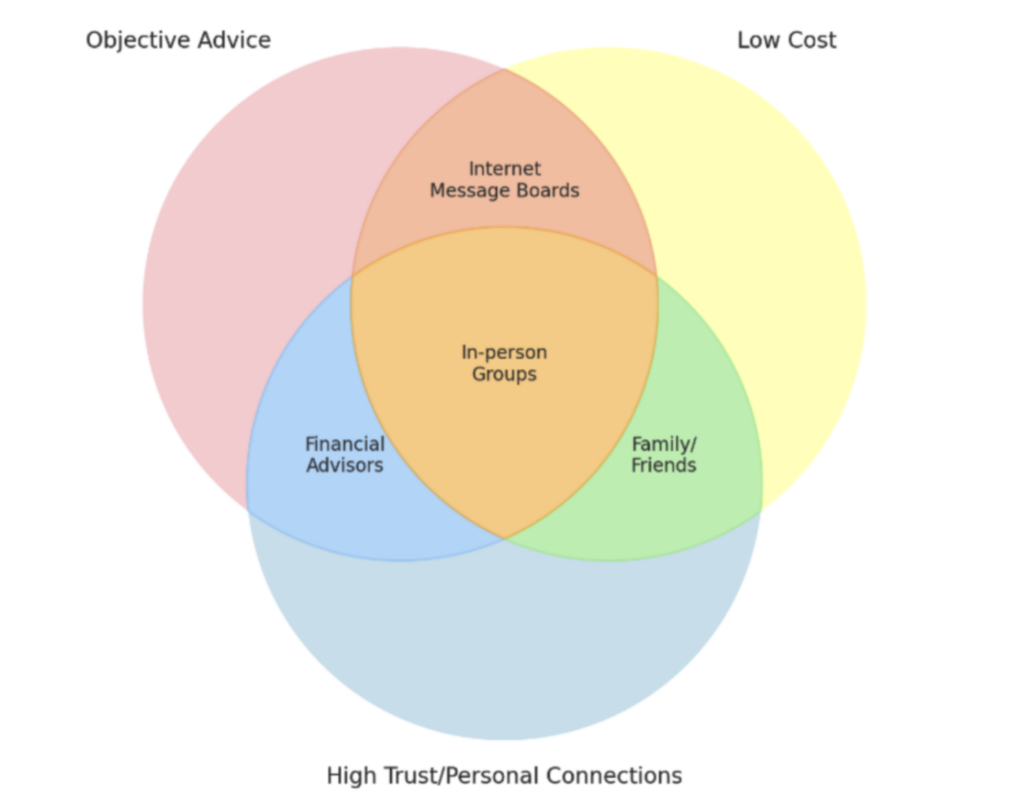

Seeking advice sometimes means working with a financial advisor. It can also mean relying on friends and family members for advice. The Internet is another popular source of information. Over 1.4 million people subscribe to r/PersonalFinanceCanada on Reddit alone.

But private gatherings — a space usually reserved for activities like running or biking, not financial literacy — are different.

Joining a financial discussion group requires more commitment than downloading an app and provides more anonymity than some may be comfortable with.

Those involved, however, say that the investment of time and effort can result in significant returns.

Why talking about money is important

“It’s my opinion, how badly educated people are in finance and how they’re being taken advantage of right, left and centre,” says Aaron McCay, who has been a member of the Calgary ShareClub for years. 10 and now he is the chairman. of the group.

It’s hard to disagree.

Only 47% of Canadians describe themselves as financially literate, according to data collected by the Financial Consumer Agency of Canada (FCAC) in 2023. Almost half of households reported using a budget – which means the other half is not.

Almost a third (32%) of working people in Canada have not saved for retirement, according to the 2023 Healthcare of Ontario Pension Plan survey. And, among homeowners, a group often associated with financial stability, two-thirds report having difficulty meeting their financial obligations, the FCAC found.

ShareClubs provide a way for individuals to combat these and other financial problems by tapping into the financial wisdom of their neighbors.

It would be foolish to suggest that joining a financial group is the ideal substitute for a financial advisor or tax preparer in all cases. However, these groups offer a combination of qualities that you won’t find elsewhere.

Inside the currency union

A regular ShareClub meeting begins with updates from a stock market game, where members compete to see who can earn the highest annual returns on fictional portfolios. . It’s like fantasy sports, but for investing.

Most of each session is reserved for discussing current financial events, hearing from guest speakers and asking questions.

McCay said that some of the people who came to the meeting “are there out of necessity” because they feel the need to control some part of their finances. There are others who appreciate sharing what they know. “They have wisdom to offer,” says McCay. “They learned the school of hard knocks.”

It is difficult to provide direct access to these types of experiences.

Multi-millionaire entrepreneurs and business managers can stay with people who are just starting their careers or else starting from square one, financially. Regardless of background, everyone can participate in some way.

“I encourage everyone to come to the first two meetings, sit back, relax, just listen, you know – soak it in,” he says. And then I say, ‘start asking questions because I’m sure there’s someone in this room who’s had to deal with what’s bothering them.’

Calgary isn’t the only ShareClub around. They started in the 1990s with advertising support from magazines Canadian MoneySaver (which no longer provides publicity). Chapters sprang up throughout Canada, but, except for a common name and philosophy, they were entirely independent of one another; there is no national office or central organization.

Each group is created based on the preferences and skills of its members.

There are differences from one group to another. For example, the Calgary ShareClub is free to attend while the Edmonton ShareClub charges $25, which provides stipends for guest speakers and a travel trophy for the winner of the annual stock market game.

And not everyone comes in person – since the pandemic, Zooming has become an option for some.

Many people join these groups because they already love their money. But no knowledge base is required. “If you keep at it,” McCay says, “you’ll be able to handle a lot of problems by osmosis and by asking questions.”

The unfathomable wisdom of multitudes

No one promises that attending meetings is a real way to get rich. There is also no guarantee that the advice you receive is the best advice for you.

So what will the members end up getting?

For others, it can be the confidence and motivation needed to make the right financial decision. For others, it may be the ability to ask more knowledgeable questions about themselves or the financial professionals they work with.

Some benefits are harder to measure, such as timely advice. You never know, McCay says, when “a little bit of information is passed on … it saves you a lot of pain.”

Looking neighbors in the eye and hearing their stories and thoughts is a refreshing counterpoint to the notion that financial literacy is a mountain you have to climb alone, in private.

There is also a practical side to group learning; Advice embedded in the richness and complexity of an individual’s life is probably a more powerful way to learn about, say, retirement planning than reading a brochure from your bank.

Net profit

At the end of the year, one ShareClub Calgary member is the champion of the stock picking group game. In 2023, the winner’s portfolio gained 45.6%, thanks to big profits from Uber, Amazon and Alphabet.

But in the real game of managing one’s finances, there is no limit to the number of people who can come out better equipped to make wise financial choices.

Instead of winners and losers, money becomes a good game in which the whole team can progress.

GREAT CONGRATULATIONS

#Financial #Institutions #Changing #Livelihoods #Personal #Finance #NerdWallet #Canada